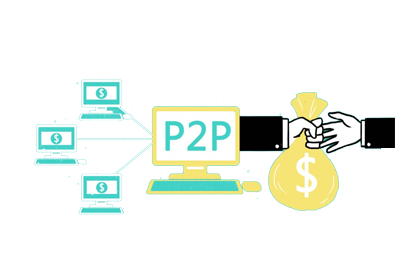

P2P Lending and Financial Portal

Peer-to-peer (P2P) and crowdsourced lending is a cutting-edge strategy for getting money to the right people, and it requires cutting-edge software and web development solutions. Shashwat India's team creates robust alternative finance solutions that tracks investments in real time.

P2P lending or Peer to Peer lending is a financial innovation that connects verified borrowers seeking unsecured personal loans from investors looking for high returns on investment. The portal allows investors to check all borrower details and lend small amounts to many borrowers simultaneously.

Enquire Now